Car accidents happen every day, but not all of them are the driver’s fault. In the UK, accidents are generally classified as either at-fault or non-fault, and understanding the difference is crucial when it comes to insurance claims, liability, and compensation.

Whether you’ve recently been in an accident or just want to be prepared, this guide will break down what non-fault and at-fault accidents mean, how they impact your insurance, and what to do if you find yourself in one.

What is a Non-Fault Accident?

A non-fault accident is one where you were not responsible for causing the incident, and the cost of repairs or compensation is covered by the other party’s insurer. An accident that wasn’t your fault means that you shouldn’t have to pay for anything regarding that incident, whether it’s a courtesy car or rehabilitation of an injury.

Examples of Non-Fault Accidents:

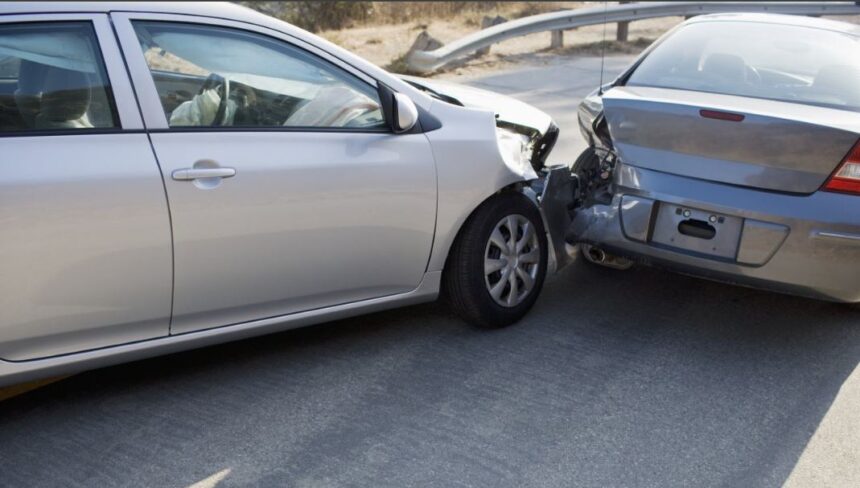

- Another driver rear-ends your car at a traffic light.

- Someone crashes into your parked vehicle.

- A driver pulls out in front of you, causing a collision.

In these cases, you are considered the innocent party, and the other driver (or their insurance) should cover your expenses. If the responsible driver is uninsured or cannot be identified (e.g., a hit-and-run), you may need to claim through the Motor Insurers’ Bureau (MIB).

What is an At-Fault Accident?

An at-fault accident is when you are responsible for causing the crash, either fully or partially. Your insurance company will cover the cost of any damages, but you may have to pay an excess, and your premiums will likely increase.

Examples of At-Fault Accidents:

- You run a red light and hit another car.

- You misjudge a turn and collide with another vehicle.

- You reverse out of a parking space without checking properly and hit another car.

In some cases, fault can be shared between multiple drivers, which is known as split liability. This often happens in cases like roundabout collisions or lane-changing accidents where both parties may have contributed to the crash.

Key Differences Between Non-Fault and At-Fault Accidents

While the definitions are clear, there are several key differences between at-fault and non-fault accidents that every driver should be aware of.

-

Who Pays for the Damages?

- Non-fault accident: The other driver’s insurance covers your costs.

- At-fault accident: Your insurance covers the other driver’s damages, and you may have to pay an excess.

-

Impact on Your Insurance Premiums

Even if you were not at fault, some insurers may still increase your premium after a non-fault claim. This is because statistics suggest that drivers involved in any accident—regardless of fault—are more likely to be involved in another one. However, at-fault accidents almost always lead to a more significant premium increase.

-

How the Claims Process Works

- Non-fault accident: Your insurer may handle the claim and recover costs from the at-fault driver’s insurer. You might also use an accident management company to handle repairs and a courtesy car.

- At-fault accident: You claim through your own insurance, and your no-claims bonus may be affected unless you have protection.

-

Legal and Financial Consequences

If you were at fault and caused significant damage or injuries, the other party may take legal action. Additionally, if you have only third-party insurance, you will not be covered for repairs to your own car.

How is Fault Determined in a Car Accident?

Insurance companies use various methods to determine fault in an accident. They consider:

- Dash cam footage: Clear video evidence can be crucial.

- Witness statements: Other drivers or pedestrians can help establish what happened.

- Police reports: If the accident was reported, the police record might indicate who was at fault.

- Traffic laws: Insurers assess whether any road laws were violated.

If fault is disputed, insurers may negotiate or split liability, meaning both parties share responsibility for the damages.

Conclusion

Understanding the difference between non-fault and at-fault accidents is essential for all drivers. Knowing who is responsible, how insurance is affected, and what to do after an accident can make the claims process smoother and help you get the compensation you deserve.

If you’re ever involved in an accident, staying informed and taking the right steps can make all the difference. Take a moment to review your insurance policy and consider whether additional protections—like a dash cam or legal cover—might be a smart investment.